Hey Friends! Today I’m going to tell you about how you can calculate annual income. I hope this topic will be very useful for you. So let’s start.

Calculating how much money you make in a year might seem straightforward. It is easy to assume that your income is simply what you get paid for your job.

But there is more to it than that. The job market is a lot more complicated than it once was, with more people doing contract work (which typically does not include tax withholding) rather than working a traditional job. On top of that, there are other sources of income, such as income from a side hustle or interest from a savings account. Not all of these income types have the same effects on your annual income or your taxable income and that’s before deductions come into play.

What is annual income?

Annual income is the total amount of income you earned in a calendar year or fiscal year before taxes and deductions.But the definition and amount can vary slightly depending on the type, you are referring to;

1. Gross Annual lncome:

Your gross income is the total income that you earn during the year before taxes. If your yearly salary is 60,000 dollars before taxes than 60,000 dollars will be your gross income. ( Gross income is what you will be quoted when given the base salary for a job.

2. Net Annual Income:

Your net income is the amount of money you earn yearly after taxes and deductions. So if your annual salary is 60,000 dollars but you only take home 45,000 dollars after taxes deductions,then 45,000 dollars is your net income.If you are filling out a credit card application, you may be asked for your gross or net income. So it is important that you know the difference and can give the correct number when asked.

How do you calculate your annual income?

Calculating your annual income can depend on a few things, like:

• The type of job you have

• How many jobs or sources of income you have

• How often you get paid for each

But if you are a salaried employee who is generally paid the same amount each pay period, you can use the following steps to figure out your annual gross income.

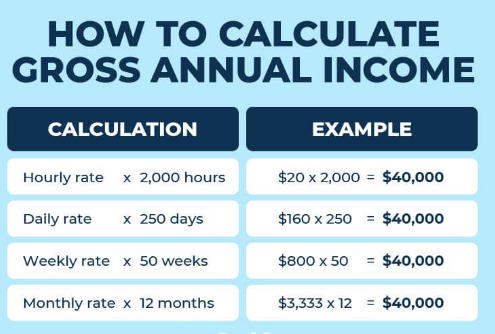

How to calculate annual gross income:

1.Figure out what your gross pay is by looking at your most recent pay stub. Gross pay is the amount you earn before taxes and any other deductions are taken out.

2. Determine how often you’re paid. Pay periods usually happen either weekly, biweekly or bimonthly. Once you know how often you are paid, figure out how many times you will get paid that year.

3. Multiply your gross pay by the number of pay periods you will have in that year. The resulting number is your annual gross income, or the amount you make before any taxes or other deductions are taken out.

For example, if you’re paid $2,800 on a biweekly basis_ Which comes out to 26 pay periods in a year_ the calculation might look like this:

$2,800 per paycheck × 26 pay periods = $72,800 annual gross income

And if you’re an hourly employee or have more irregular paycheck, you can use this approach:

1. Determine your hourly rate by referring to your most recent pay stub and dividing your gross income by the number of hours worked in that pay period.

2. Calculate how many hours you work per week or the average number of weekly hours worked if it varies to determine your weekly pay.

3. Figure out your annual gross income by multiplying your weekly pay by 52 weeks in a year.

For example, if you earn $15 an hour and work an average of 35 hours every week, the calculation might look like this:

($15 par hour × 35 hours per week) × 52 weeks = $27,300

How to calculate annual net income :

Once you know your annual gross income, you can figure out your annual net income. This calculation is typically simple and can help to understand how much of paycheck is withheld or deducted for taxes, retirement and more.

To calculate net income, you take your gross income and subtract any deductions. Deductions often include things like taxes, retirement contributiond and insurance. Your pay stub should provide you with all of this information like which deductions you have taken out of your paychecks and in what amounts.

• Using an annual income calculator

To get a more comprehensive idea of how much money you may bring home in a year, it might help to use an online annual income calculator. That’s because these calculators may take other factors into account when calculating your annual income.

Healthcare.gov, for example,has an annual income calculator that takes income and expenses into account. The calculator is set up to measure specific expenses, like student loan interest and IRA contributions, but you can still use it for other expenses to get an idea.

Understanding how much money you may have coming in throughout the year can make it easier to establish and stick to a budget. Plus, if you have multiple sources of income, you can see how these income streams add up to your total annual income.

Calculating your yearly income can also help you see how your money is used for various expenses and how much may be left for meeting financial goals, like buying a house or building an emergency fund.

You might also need to know your annual income in a specific situations, like of you’re applying for a loan, applying for your city’s affordable housing program or paying child support.

While you may know how much money you make annually on paper, breaking down how much you actually take home can help you fully understand where all that money goes. That can make it easier to create and stick to a budget and decide if it’s worth pursuing additional income to help you reach your financial goals.I hope this article has given you ideas about how to calculate your annual income.